Bitcoin, Criptomonedas, Forex

Top Five Risks Related to Crypto Exchanges

Cryptocurrencies are exposed to market volatility. If you want to be a successful trader in cryptocurrencies, you must be aware of various risks. You can seek the bitcoin code help to stay updated about the current market scenario’s cryptocurrencies. If you want to gain profit from cryptocurrency trading, then you need to sharpen your skills every time.

Suppose you want to become successful in cryptocurrency trading. Then you need to sharpen your technical skills, and you must possess at least the basic knowledge of how blockchain technology works. You need to understand the risk associated with the cryptocurrency business to get over with it.

Five risks associated with the cryptocurrency business:-

There are several risks associated with cryptocurrency exchanges, and many of us are not aware of that. Therefore, let’s explore the risks associated with the cryptocurrency business one after the other to get a better insight into it.

- Loss or the destruction of the private key:- In the case of all, the types of cryptocurrencies are stored in the digital wallet. These currencies are controlled by private and public keys related to digital wallets where bitcoins are held, and both are unique.

Now, if you lose this private key or this key gets destroyed and compromised due to specific reasons, then you may lose the access to gain entry to your bitcoin or your cryptocurrency wallet. If any third party acquires your private keys, they can easily access your bitcoin or cryptocurrency wallet. Hence, it would be best to keep your private keys safe and secure to do trading properly. The private keys are the door to your entry in the crypto trading; therefore, you cannot afford to lose it.

- Cybersecurity risks from malicious activity:- Third-party service providers and trading platforms are vulnerable to hacking and other malicious activities. In 2016, nearly 120000 units of the bitcoins worth $72million were stolen from the Bitfinex exchange in Hongkong.

Due to this factor, it had led to an immediate drop of 23% price in bitcoins. Due to a phishing attack, $1.8 million was lost from the Bit Pay account in its previous year. This is why cryptocurrency trading is vulnerable to the cyber attack.

- Risks associated with peer-to-peer transactions:- Multiple online platforms, digital currencies are traded to third-party service providers. Many counterparties come together without providing any intermediary services being regulated.

In such a scenario, risks remain between the two parties involved in the process of transactions. The main reason for such risks is the absence of the regulatory bodies in the entire process of transactions. Hence, it would help if you were very careful while trading in bitcoins. Otherwise, you may have to face heavy losses that are beyond your imagination. It would be best if you were careful while trading in cryptocurrencies.

- Loss of confidence in digital currencies:- Most of the people of the world are habituated in making transactions through paper currencies. Now the concept of digital money is a very new concept towards them. The central banks of the country do not regulate the cryptocurrency business. There are no financial regulatory bodies that can control its operation. Hence, the entire currency profitability depends on the trust and the confidence of the people on cryptocurrencies.

Therefore, if people lose their confidence in cryptocurrencies, the entire business will collapse quickly. It would be best if you considered these factors deeply while trading in cryptocurrency.

- Regulations restrict trading in digital currencies:- Some criminals and terrorist organizations often use digital currencies. Therefore many countries of the world restrict trading in cryptocurrencies. The reason being trading cannot be allowed by compromising the safety of the nation.

Conclusion:-

Hence, from the above information, it is obvious how cryptocurrencies can affect an individual’s financial health. Before trading in bitcoin or any other types of cryptocurrencies, you must adequately consider the risk factors. Otherwise, you may get vulnerable to high-risk factors related to cryptocurrency trading in the country. You need to be aware of the current market scenario before trading in the crypto business. Thus, while trading in cryptocurrencies, you need to be more careful and vigilant. You cannot take things for granted. You need to know the factors that can pose threats.

-

Bonos Casas de Apuestas4 días ago

Los Mejores bonos de Bienvenida en Fiebre de Casinos ◀︎

-

Méjores casas de apuestas1 semana ago

The Best Ways to Make Profit from Your Online Casino Business

-

Uncategorized1 semana ago

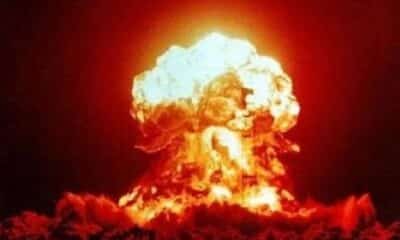

Porqué Rusia derribó F-35 de Israel Cargado con Bomba Nuclear

-

Actualidad1 semana ago

Remate estafa de América Televisión aún no esclarecido

![Peligra CUSCO alerta experto Mundial en Explosivos [VIDEO] 138](https://pysnnoticias.com/wp-content/uploads/2021/10/MINIATURA-CASO-CUSCO-80x80.png)