Economía y Negocios

7 Rules Every Crypto Futures Trader Must Know ◀︎ll

7 Rules every crypto futures trader must know. Futures trading is a popular advanced tool in traditional markets, allowing traders to speculate on commodities prices. This financial instrument is based on a trader’s thorough understanding of the market and the ability to foresee its movements, considering all the external factors that may have an impact on it.

Crypto futures trading has the same idea – speculation and risk hedging based on the analysis and predictions made concerning an underlying asset. In the digital space, the tool of the future appears to be even riskier because predictions on the crypto market are rarely precise. The fact is that this market is not regulated and only depends on the balance between demand and supply as well as media coverage. Anything may happen next moment, and the market will turn in another direction. So in this article, we would like to underline 7 things you should know about cryptocurrency futures trading:

7 Rules Every Crypto Futures Trader Must Know

trade futures – trading plan – the markets – futures how

- Pick a strategy

- Use stop-loss

- Do not trade on several markets at once

- Do not rush

- Use margin

- Be patient

- Go long and short.

Let’s consider some of these paragraphs in more detail.

Have a Plan

In any business, having a plan is halfway to success. You should select a futures trading strategy and set a real objective for it. Also, you should know under what conditions you will exit your position. For example, if the market moves against you. Think carefully about risks you take and use such tools as stop-loss. A plan is needed to help you be consistent and not to be guided by emotions.

Determine with Stop-Loss

Stop-loss is not the price you keep in your head, for when the asset reaches it, you will leave your positions. It is easy to ignore such a price level. You should better use a stop-loss instrument to leave the market as soon as the asset reaches the level you set for yourself. The program will automatically execute your exit.

Do Not Be Distracted On Other Markets

Crypto futures trading is quite a complex instrument. It requires that you constantly track the market and analyze it, watch the trends, news background, etc. So it would be wrong to start a few different market trading simultaneously, for it will not allow you to focus on futures trading in full.

Don’t Rush

Take your time and develop your trading methodology, and when you find the best trading style, increase your order size little by little. Do not invest large amounts as long as you are only looking for your best trading strategy.

To trade crypto futures, you may use the WhiteBIT crypto exchange. To learn more tips on trading, welcome to the WhiteBIT blog.

Pysnnoticias

no loss future trading strategy – futures trading strategies pdf – profitable futures trading strategies – futures trading strategies crypto – futures trading for beginners 7 Rules every crypto futures trader must know – 7 Rules every crypto futures trader must know – 7 Rules every crypto futures trader must know – 7 Rules every crypto futures trader must know – 7 Rules every crypto futures trader must know – 7 Rules every crypto futures trader must know – 7 Rules every crypto futures trader must know – 7 Rules every crypto futures trader must know – 7 Rules every crypto futures trader must know – 7 Rules every crypto futures trader must know

-

Bonos Casas de Apuestas3 días ago

Los Mejores bonos de Bienvenida en Fiebre de Casinos ◀︎

-

Méjores casas de apuestas7 días ago

The Best Ways to Make Profit from Your Online Casino Business

-

Uncategorized6 días ago

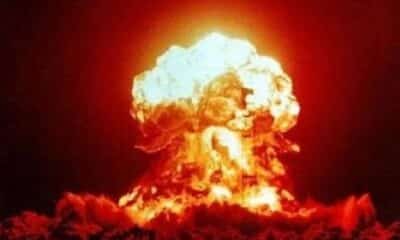

Porqué Rusia derribó F-35 de Israel Cargado con Bomba Nuclear

-

Actualidad1 semana ago

Alan Dejó su Cadaver como Desprecio a sus Adversarios

![Peligra CUSCO alerta experto Mundial en Explosivos [VIDEO] 136](https://pysnnoticias.com/wp-content/uploads/2021/10/MINIATURA-CASO-CUSCO-80x80.png)